us germany tax treaty summary

61 rows Summary of US tax treaty benefits. The purpose of the Germany-USA double taxation treaty.

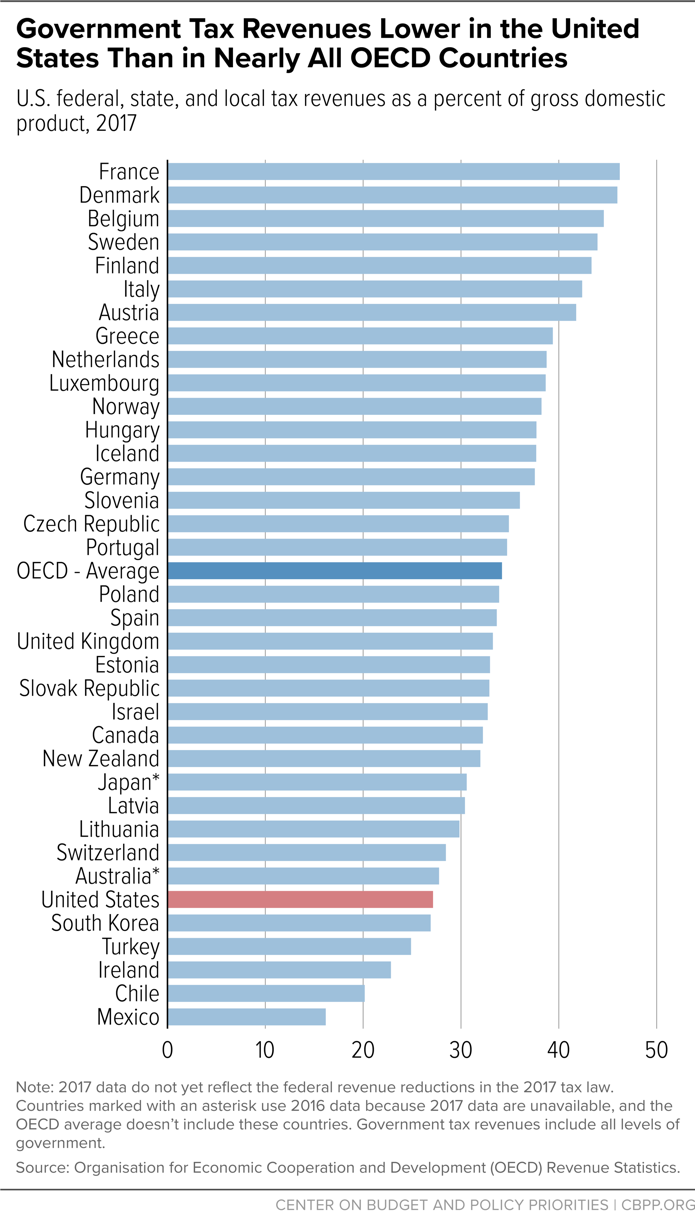

How The Federal Tax Code Can Better Advance Racial Equity Center On Budget And Policy Priorities

The Convention Between The United States Of America And The Federal Republic Of Germany For The.

. German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one country. A separate protocol and an accompanying joint. Germany - Tax Treaty Documents.

The United States is a party to. Germany and the United States have been engaged in treaty relations for many years. The complete texts of the following tax treaty documents are available in Adobe PDF format.

The purpose of the. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability to 1300. Convention between the United States of.

If you have problems opening the pdf document or viewing. Tax Notes is the first source of essential daily news analysis and commentary for tax professionals whose success depends on being trusted for their expertise. The Convention between the Federal Republic of Germanyand the United States of America for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to taxes.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990. Four of the most important estate tax treaties to which the United States is a party - the treaties with France Germany the Netherlands and the United Kingdom.

Germany and the United States signed an income and capital tax convention and an accompanying protocol on August 29 1989. Each of these treaties follows. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

The United States Government and the. The treaty has been updated and revised with the most recent version being 2006. The protocol signed at berlin on june 1 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double.

United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income. This will be a major benefit to United States multinationals with investments or plans to invest in the Federal Republic of Germany. Taxes for Expats The US Germany Tax Treaty.

:max_bytes(150000):strip_icc()/dotdash-brief-history-international-trade-agreements-v2-2d7ef50e8498475e927985609a9d0308.jpg)

A Brief History Of International Trade Agreements

Global Tax Deal Reached Among G7 Nations The New York Times

Doing Business In The United States Federal Tax Issues Pwc

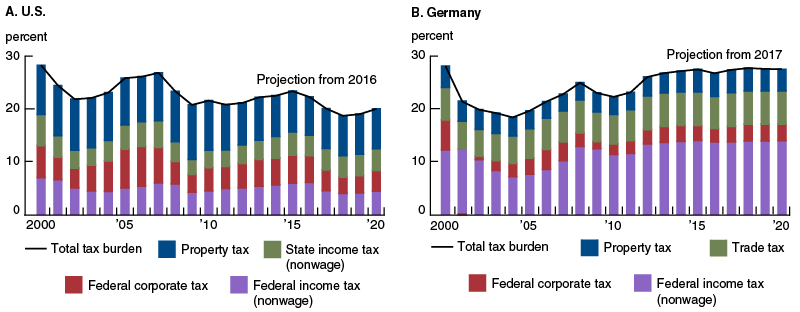

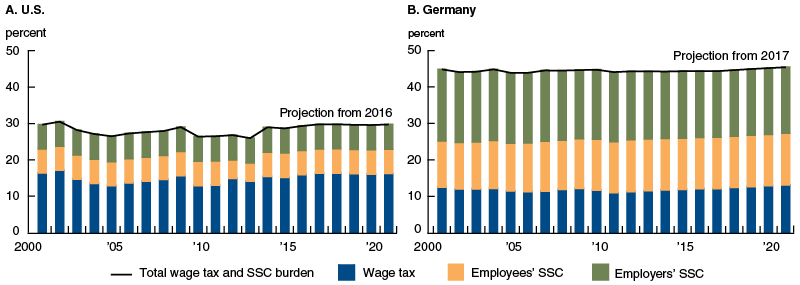

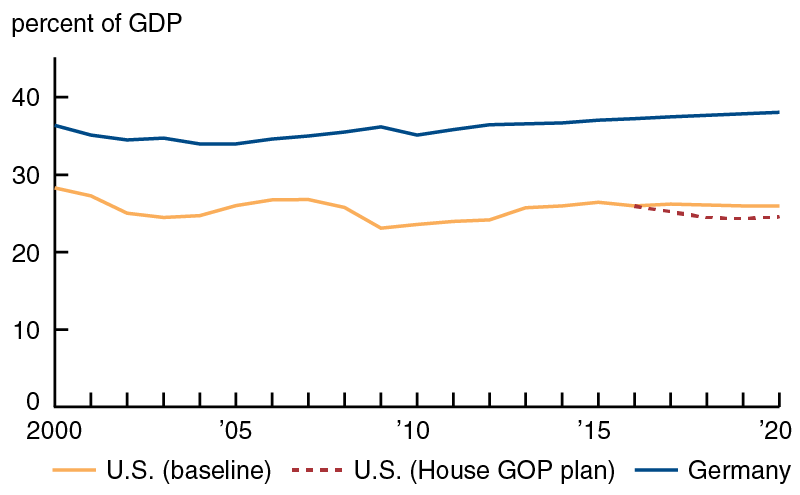

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Us Expat Taxes In Germany A Complete Guide

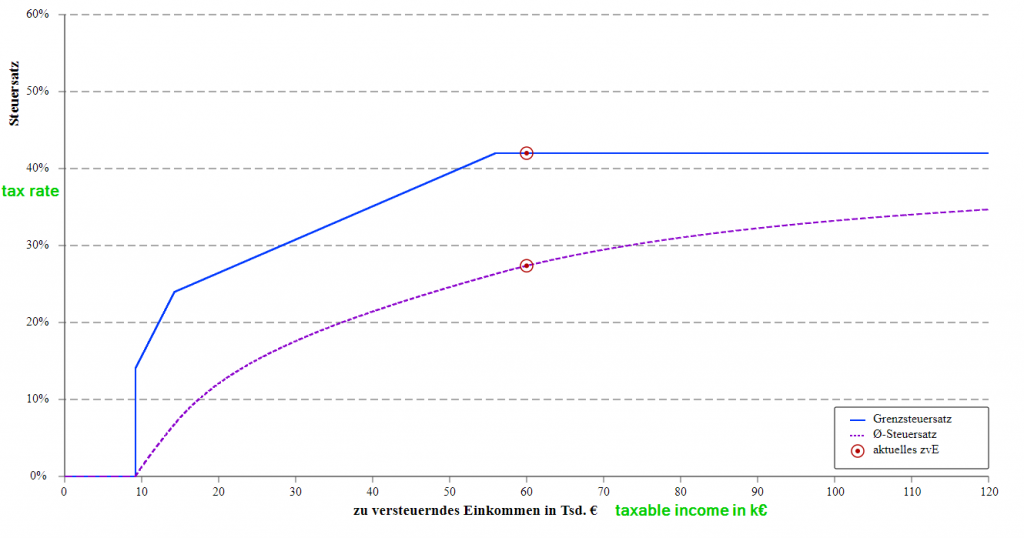

Faq German Tax System Steuerkanzlei Pfleger

Joint Economic Committee Tax Hearing Build Back Better Revenue Items

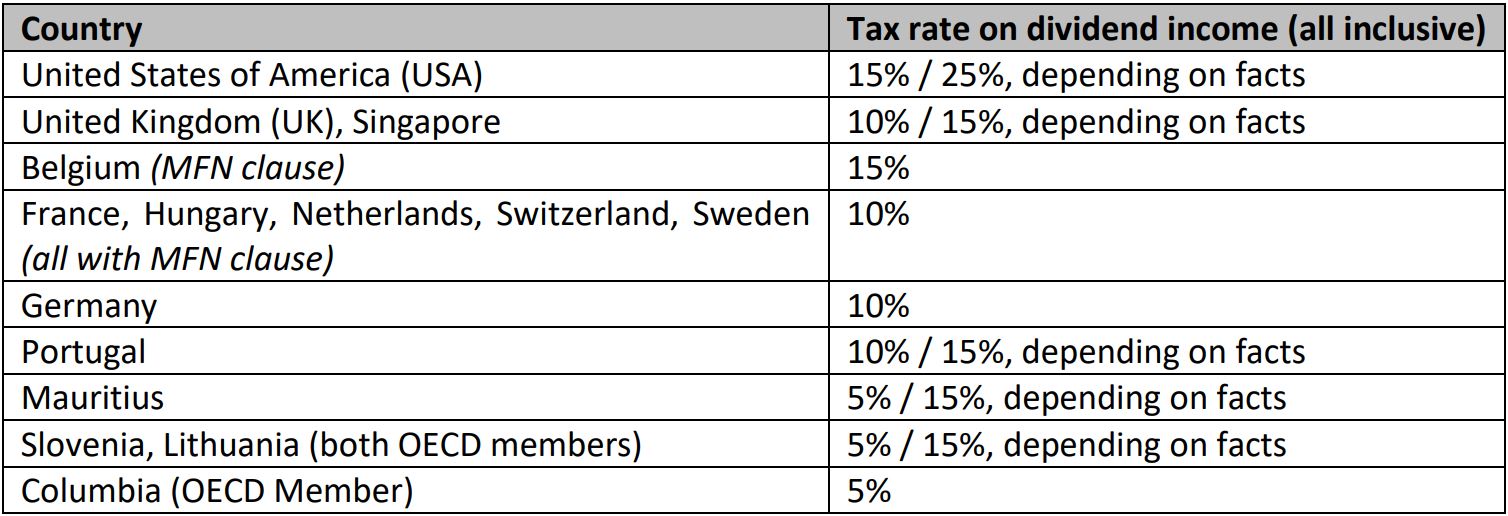

Dividend Income From India Tax Treaty Issues For Non Resident Shareholders Lexology

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

The Burden Of Taxation In The United States And Germany Federal Reserve Bank Of Chicago

Nato Founders History Purpose Countries Map Facts Britannica

Your Bullsh T Free Guide To Taxes In Germany

Germany Taxation Of International Executives Kpmg Global

Your Bullsh T Free Guide To Taxes In Germany

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

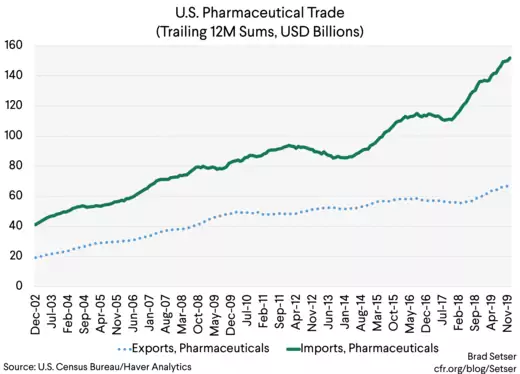

Tax Games Big Pharma Versus Big Tech Council On Foreign Relations