tax identity theft form

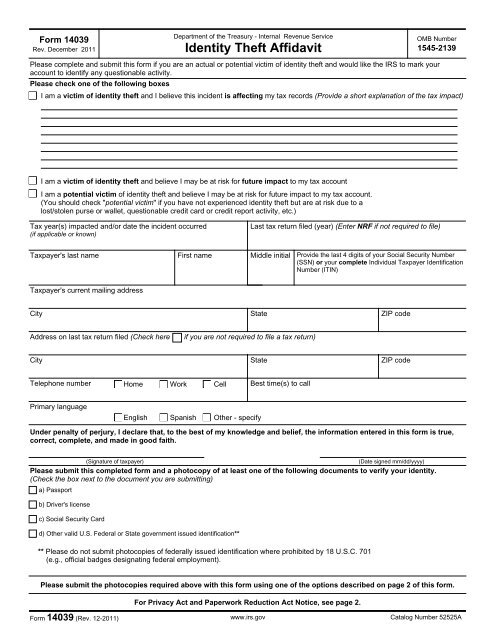

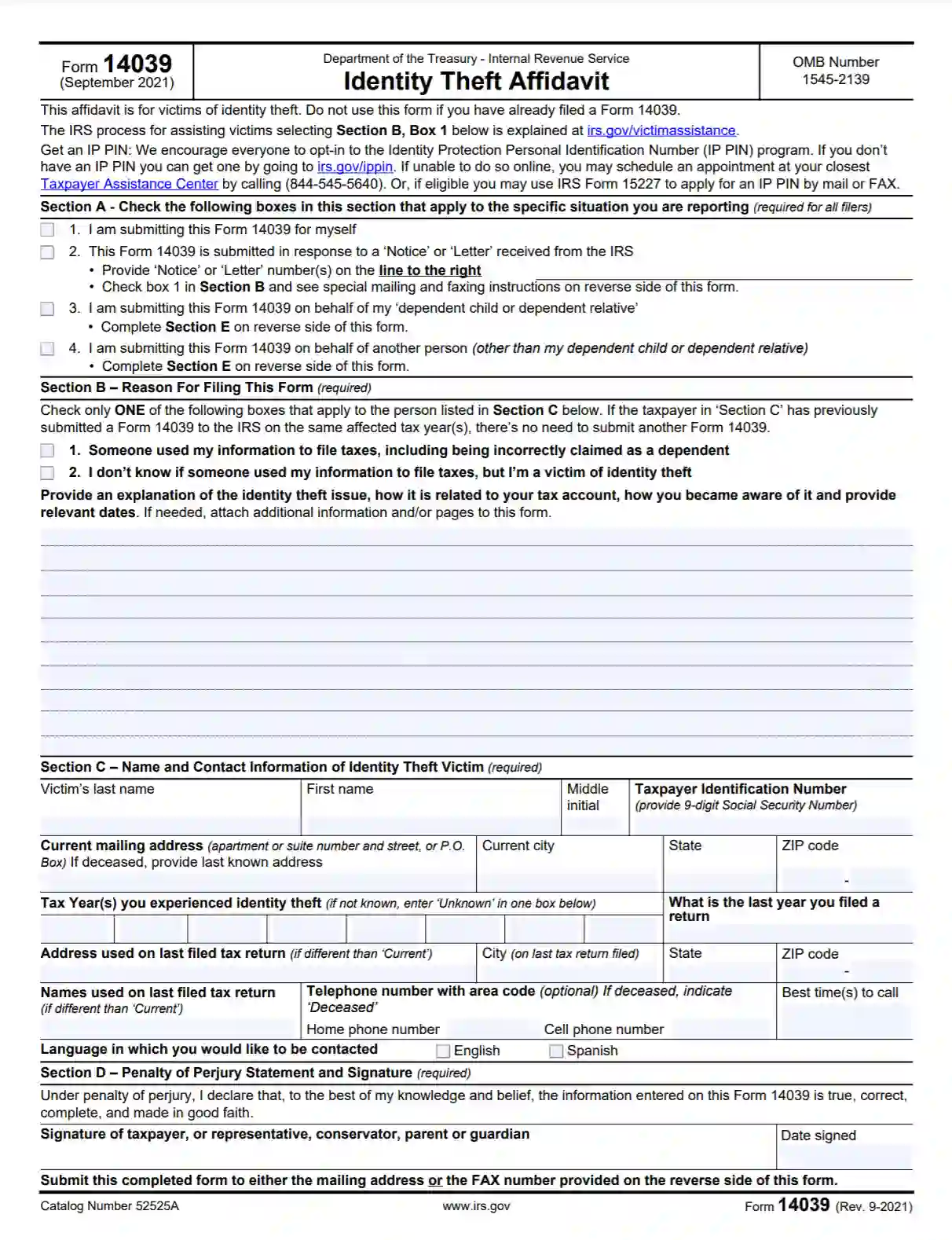

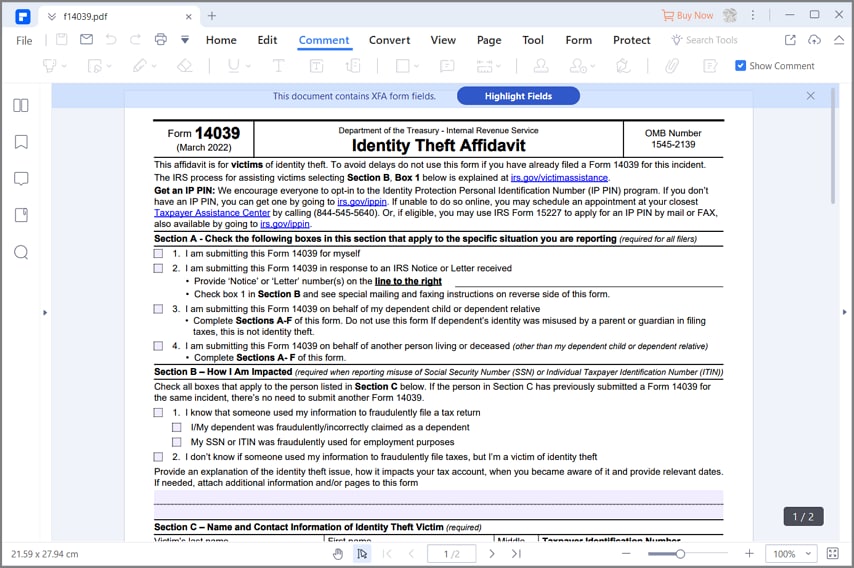

If you choose IdentityTheftgov will submit the IRS Identity Theft Affidavit to the IRS. See the Instructions for Submitting this Form in Form 14039 for information on submitting it by mail or fax.

Victim Of Identity Theft Protect Your Tax Return With Irs Form 14039 The Handy Tax Guy

Improve Visibility and Control Access with Adaptive Policies Based on Contextual Factors.

. Identity theft victims should submit a Form 14039 in the following cases. They may use your. Complete IRS Form 14039 Identity Theft Affidavit if your e-filed return is rejected because of a duplicate filing under your Social Security number SSN or you are instructed to do so.

You may also contact the IRS for specialized assistance at 800-908. PdfFiller allows users to edit sign fill and share all type of documents online. Request for Transcript of Tax Return Form W-4.

Ad Guard Against Breaches of Lost or Stolen Credentials with Password Protection. Learn more about tax identity theft with the experts at HR Block. Identity theft victims should submit a Form 14039 in the following cases.

The tax identity theft risk assessment is based on various data sources and actual risk may vary. Print it then mail or fax it according to instructions. Social security number SSN Credit card number.

Identity Theft Affidavit Complete and submit this form if you are an actual or potential victim of identity theft and would like the Franchise Tax Board FTB to update your account status to. If you believe your tax identification number has been stolen and someone has filed a Colorado tax return under your Social Security Number SSN please fill. Apr 23 2014 CP080 We credited payments andor other credits to your tax account for the form and tax period shown on your notice.

If someone has fraudulently filed a tax return with your SSN use Form 14039 to fix the situation. Identity Theft Your Tax Return. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number.

IdentityTheftgov will create your. However we havent received your. Identity theft is someone else using your information for an unlawful purpose.

Complete IRS Form 14039 Identity Theft Affidavit. 275001160094 DTF-275 516 Department of Taxation and Finance Identity Theft Declaration Taxpayers last name First name Middle Last 4 digits of social Document locator number. IRS Tax Tip 2022-56 April 12 2022 When a thief steals someones Social Security number they can use it to file a fraudulent tax return.

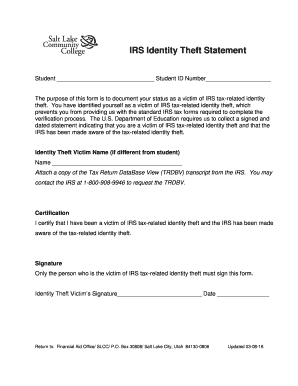

Individual ID theft may involve stealing. You should use this form if you are a victim of tax related identity theft whose name and Social Security Number SSN was used to file a fraudulent tax return. Tax Considerations in Handling Identity Theft.

You may fax or mail your documents to our identity. Continue to pay your taxes and file your tax return even if you must. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Individual identity ID theft is a fraud that is committed or attempted using a persons identifying information without authority. They are having specific tax-related. IdentityTheftgov will first ask you questions to collect the information the IRS needs then use your information to populate the Form 14039 and let you.

Heres how it works. A photocopy of your government-issued ID such as a drivers license US passport or US military ID card. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Using all 3 will keep your identity and data safer. In its annual release in 2016 the Federal Trade Commission noted that reports of identity theft increased more than 47 percent. Ad Download or Email TWC Forms More Fillable Forms Register and Subscribe Now.

Due to federal privacy laws the. This is tax-related identity theft. Taxpayers file the Form 14039 to inform the Internal Revenue Service that they think they may be a victim of tax-related identity theft.

If this happens go to IdentityTheftgov and report it. The tax identity theft risk assessment is based on various data sources and actual risk may vary. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

Sample Irs Identity Theft Report Law Looper Store

Taxpayers Tips Who Are Victims Of Identity Theft

Tax Identity Theft Awareness Week Firstmark Credit Union

Special Forms Of Identity Theft Truleap Technologies

Identity Theft What To Do If Someone Has Already Filed Taxes Using Your Social Security Number Turbotax Tax Tips Videos

Identity Theft Affidavit How To Complete The Irs Form 14039 Youtube

Irs Form 14039 Fill Out Printable Identity Theft Affidavit

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

Tax Identity Theft Tax Refund Fraud Lancaster Cpa Firm

Fillable Online Slcc Irs Identity Btheftb Statement Slcc Slcc Fax Email Print Pdffiller

Irs Form 14039 Guide To The Identity Theft Affidavit Form

Tax Identity Theft City Of Roseville

How To Help Avoid Tax Identity Theft Identityiq

New Tax Phishing Scam Targets Students Edu Emails Don T Mess With Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/J44JHOD7ZRDBZP2RNQX32PZWQM.jpg)

Could New Tax Law Increase Identity Theft Fraud Cases

Fake Irs Form Mail Fraud Latest Tax Identity Theft Scam Don T Mess With Taxes

Irs Form 14039 How To Fill It With The Best Form Filler

1099 G Form Could Surprise Many With Unemployment Benefits Fraud Itrc